The retailer reported earnings, which were fine on the top line, but not so great on the bottom. We routinely post important information for investors on our website in the “Investor Relations” section. We intend to use this webpage as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts.

Vera Bradley Scores a Touchdown with National Football League Collaboration – Marketscreener.com

Vera Bradley Scores a Touchdown with National Football League Collaboration.

Posted: Thu, 10 Aug 2023 07:00:00 GMT [source]

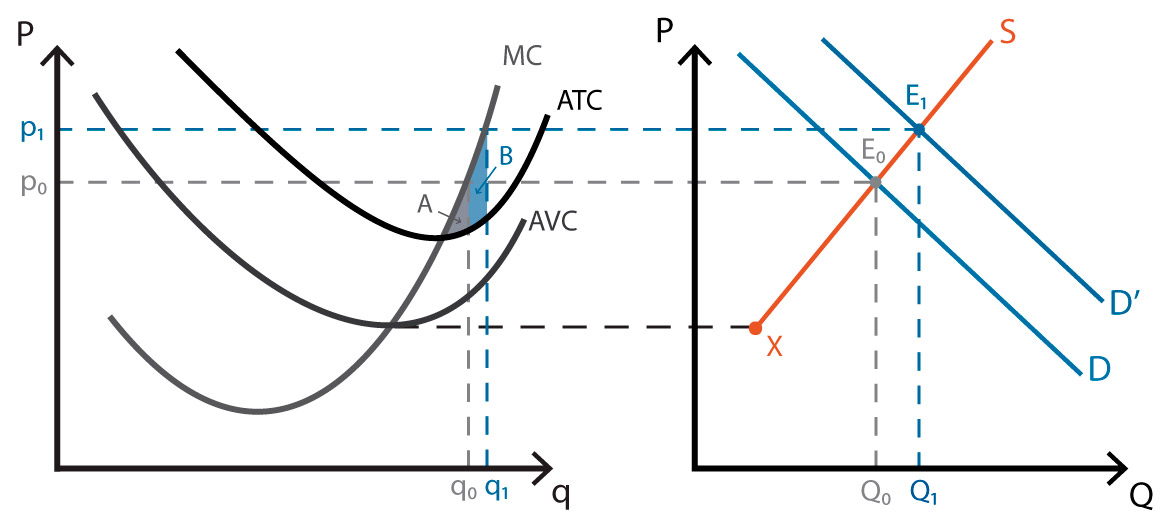

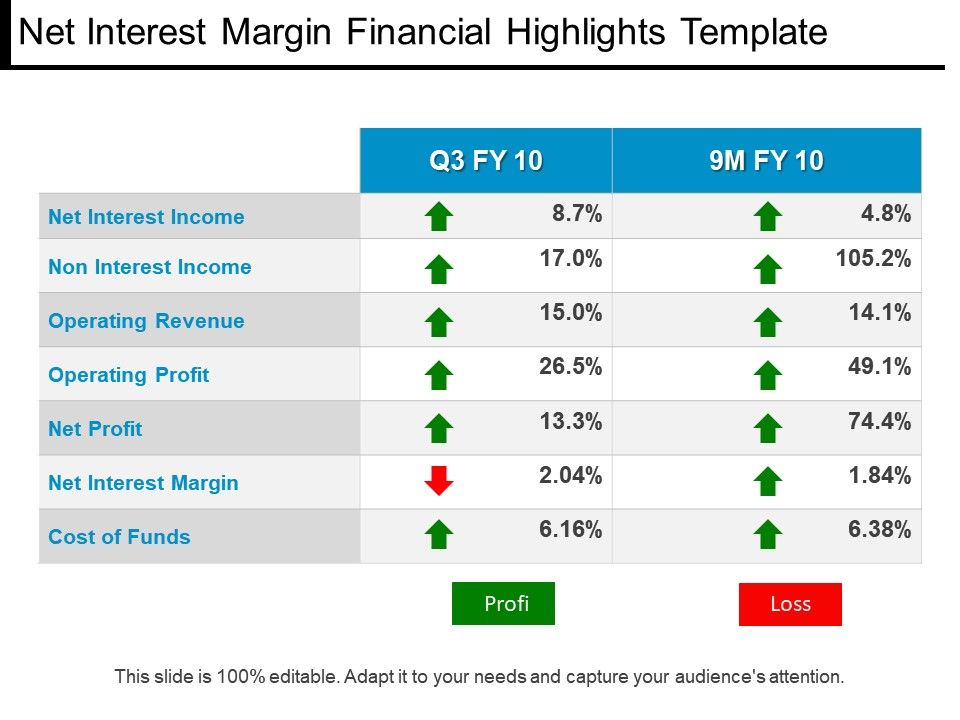

More value-oriented stocks tend to represent financial services, utilities, and energy stocks. The Company has $26.3 million remaining under its $50.0 million repurchase authorization that expires in December 2024. Consolidated net revenues totaled $128.2 million compared to $130.4 million in the prior year second quarter ended July 30, 2022. Management is updating certain components of guidance for the fiscal year ending February 3, 2024 (“Fiscal 2024”) based on first half performance, Company initiatives underway, and current macroeconomic trends and expectations. The Company has narrowed the guidance range for diluted earnings per share. Shares of Vera Bradley (VRA -2.14%), the maker of women’s handbags and accessories, were moving higher Wednesday after the company reported better-than-expected results for its fiscal 2024 second quarter.

Trading Services

The company is scheduled to release its next quarterly earnings announcement on Wednesday, December 6th 2023. Following the success of last year’s popular collection, the iconic brands launch two new sets of Tupperware food and beverage products featuring unique Vera Bradley designs, just in time for summer a… VRA’s beta can be found in Trading Information at the top of this page. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Style is an investment factor that has a meaningful impact on investment risk and returns.

Pre-Market Earnings Report for August 30, 2023 : PDCO, REX … – Nasdaq

Pre-Market Earnings Report for August 30, 2023 : PDCO, REX ….

Posted: Tue, 29 Aug 2023 20:00:00 GMT [source]

Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Consolidated gross profit for the six months totaled $123.8 million, or 55.6% of net revenues, compared to $113.0 million, or 49.4% of net revenues, in the prior year.

Vera Bradley (VRA) Is a Great Choice for ‘Trend’ Investors, Here’s Why

On a non-GAAP basis, current year consolidated SG&A expense totaled $113.9 million, or 51.2% of net revenues, compared to $123.4 million, or 53.9% of net revenues, in the prior year. Vera Bradley’s current year non-GAAP SG&A expenses were lower https://investmentsanalysis.info/ than the prior year primarily due Company-wide cost reduction initiatives across various areas of the enterprise. Vera Bradley Indirect segment revenues totaled $17.4 million, a 0.2% increase over $17.3 million in the prior year second quarter.

The Motley Fool has no position in any of the stocks mentioned. For the full fiscal year, the company forecast revenue of $490 million to $500 million. Upgrade to MarketBeat All Access to add more stocks to your watchlist. 151 employees have rated Vera Bradley Chief Executive Officer Robert Wallstrom on Glassdoor.com. Robert Wallstrom has an approval rating of 89% among the company’s employees. Sign-up to receive the latest news and ratings for Vera Bradley and its competitors with MarketBeat’s FREE daily newsletter.

Vera Bradley Inc. shares fell nearly 3% in Wednesday premarket trading after it reported a first-quarter profit and sales miss and issued a profit warning for the year. For the six months, the Company’s consolidated operating income totaled $6.5 million, 2.9% of net revenues, compared to an operating loss of ($51.1) million, or (22.3%) of net revenues, in the prior year six-month period. On a non-GAAP basis, the Company’s current year consolidated operating income was $10.5 million, or 4.7% of net revenues, compared to an operating loss of ($2.9) million, or (1.2%) of net revenues, in the prior year. Vera Bradley Indirect segment revenues for the six months totaled $32.7 million, a 4.6% decrease from $34.3 million last year. Prior year revenues reflected a large one-time key account order that was not repeated in the current year. The Company’s second quarter consolidated operating income totaled $12.9 million, or 10.0% of net revenues, compared to an operating loss of ($42.8) million, or (32.8%) of net revenues, in the prior year second quarter.

Vera Bradley Q2: EPS Beat, Sales Miss, Narrowed FY24 Outlook & More

Management lowered its outlook to reflect two new pressures on sales and earnings. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Vera Bradley Inc. said late Thursday that President Estrategias de inversion and Chief Executive Officer Robert Wallstrom plans to retire, remaining in his roles until a successor is named. Vera Bradley Inc. said Tuesday that it has named Jacqueline Ardrey as its new president and chief executive, following the retirement of Rob Wallstrom. Wallstrom, who announced his intention to retire in July, will remain…

On a non-GAAP basis, prior year gross profit totaled $120.3 million, or 52.6% of net revenues. Vera Bradley Direct segment revenues for the current year six-month period totaled $144.6 million, a 2.7% decrease from $148.6 million in the prior year. Second quarter consolidated gross profit totaled $72.0 million, or 56.2% of net revenues, compared to $60.5 million, or 46.4% of net revenues, in the prior year. On a non-GAAP basis, prior year gross profit totaled $67.8 million, or 52.0% of net revenues.

Is It Time to Buy VRA? Shares are down today.

In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. Most of the gains were gone by the end of the day, but investors were clearly excited about the company’s solid revenue growth.

- Adjusted earnings per share, meanwhile, increased from $0.08 to $0.33.

- This site is protected by reCAPTCHA and the Google

Privacy Policy and

Terms of Service apply. - At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

- There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

- That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style.

Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions. According to 4 analyst offering 12-month price targets in the last 3 months, Vera Bradley has an average price target of $9.25 with a high of $10.00 and a low of $9.00. Based on those forecasts, Vera Bradley stock looks cheap, trading at a forward price-to-earnings ratio of just 12.5. While the stock has historically struggled, the company’s turnaround efforts seem to be taking hold.

Vera Bradley Announces Reporting Date for Fiscal Year 2023 Third Quarter Results

The increasing inclination of the younger population towards fashion trends and the increased adoption of social media platforms is expected to drive growth in the fashion market. VRA said late Tuesday that is embarking on a reorganization, aiming to cut costs by an additional $12 million and replacing its chief financial officer. Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. The Zacks Industry Rank assigns a rating to each of the 265 X (Expanded) Industries based on their average Zacks Rank. As an investor, you want to buy stocks with the highest probability of success.

- The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

- Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

- A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return.

- Data may be intentionally delayed pursuant to supplier requirements.

- Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.

One share of VRA stock can currently be purchased for approximately $7.25. The Barchart Technical Opinion rating is a 100% Buy with a Weakening short term outlook on maintaining the current direction. Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. For those who can handle a higher level of volatility and have a less conservative approach, small-cap stocks could be solid considerations, as their growth potential is hard to ignore.

The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s.

After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. Margins continued to improve for the handbags and accessories company. So far today, approximately 114.07k shares of Vera Bradley, Inc. have been exchanged, as compared to an average 30-day volume of 179.47k shares. This current average has increased by 8.82% from the previous average price target of $8.50.